With a power grid that has been notoriously unreliable in the past, India’s goal to transform formerly passive consumers into prosumers would seem an uphill battle. But cutting-edge digital technologies that leverage artificial intelligence (AI) and enable these prosumers to become part of virtual power plants are ushering in innovative approaches to grid reliability and reshaping the Indian energy landscape. The stakes are particularly high because India is the world’s third largest energy consumer. What happens here carries implications for the rest of the Asia Pacific region as well as the world.

Why India’s Energy Market Matters

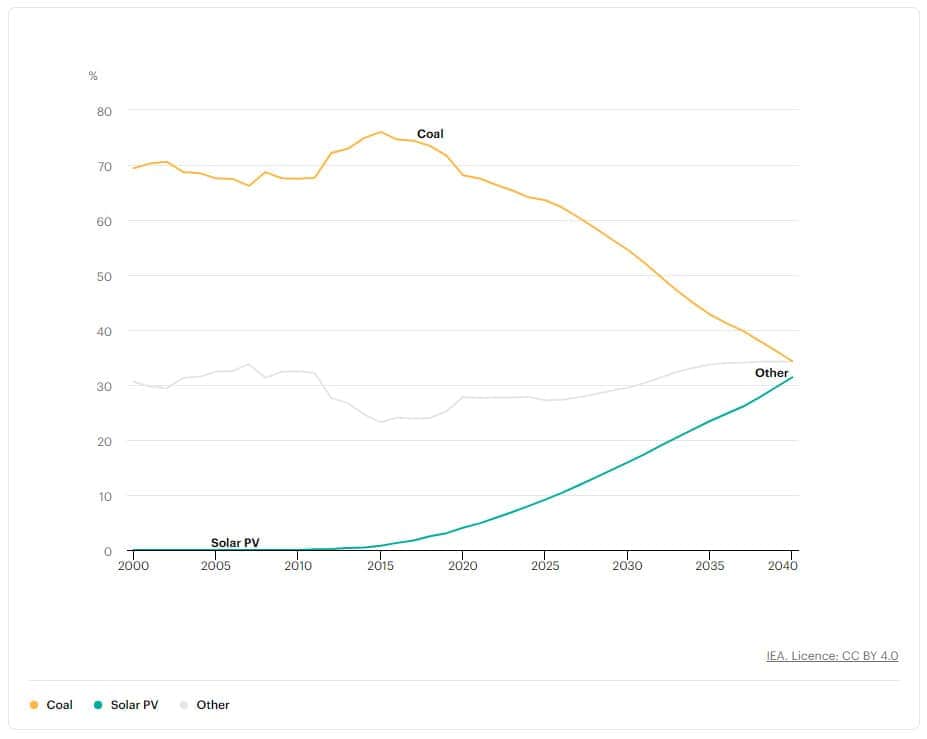

The Energy Information Agency (EIA) argues that no other country than India has as much of a pressing need for flexibility services. Its electricity demand reached an all-time demand peak of 223 gigawatts (GW) this past June, and projections indicate it could hit 340 GW by the decade’s end. To put that into perspective, the electricity demand for Germany in 2022 was 200 GW. Since India has historically relied on coal for approximately 70% of its electricity generation, reducing peak demand is critical to lowering its carbon footprint while still providing reliable electricity.

To wean itself off of coal, India will need to move away from base-load fossil fuel plants that run 24/7 to rely more on variable renewables. The EIA chart below highlights why India will need to rely on demand flexibility as it moves forward with the energy transition. As solar and other resources increase and coal use decreases, supply becomes more variable. According to the EIA’s Stated Policies Scenario (STEPS), India will have 140 GW of battery capacity by 2040, the largest portfolio of batteries of any country in the world. This growing fleet of batteries will require AI to optimize the entire grid network. India needs a grid to prosumer framework to maximize the value from non-utility prosumer assets.

Future Trends and Challenges in India’s Electricity Landscape

Other trends and challenges India will face in the future include:

- Air Conditioner Unit Growth: India is projected to install around 200 million new AC units within the next decade. Smart AC units that can respond to the need for demand flexibility via smart thermostats and other technologies are absolutely critical.

- Shifting Peak Demand: India’s peak demand for electricity traditionally occurred in the evenings. The adoption of growing numbers of AC units is leading to a shift toward afternoon peaks, typically between 2 to 5 pm. This shift also translates into the need for flexibility as solar resources decline toward the end of this demand peak period, increasing the need for batteries and demand response (DR).

- Asset Diversity: As is the case in the U.S. and around the world, the VPPs coming online today in India are multi-asset VPPs similar to deployments in Australia, integrating assets like smart AC units, rooftop solar panels, behind-the-meter batteries, and electric vehicles. Just as in the U.S., VPPs in India started with a focus on DR.

- Customer Relationships: India’s electricity customers have complex relationships with their providers due to cross-subsidization from retail rates and high levels of technical losses. Communicating the value of DR in such a context is a challenge but is crucial to maintain adequate reliability.

- Lower Energy Consumption: Energy consumption per individual may be lower per capita in India compared to Europe or the U.S., but India’s large population means that aggregate peak load reduction can still make a significant impact on carbon emission reductions and the harvesting of flexible loads for VPPs.

Case Study: Tata Power-DDL

Serving over 7 million people in the city of Delhi, Tata Power-Delhi Distribution Limited (TPDDL) partnered with AutoGrid to launch a Behavioral Demand Response (BDR) program. This form of DR is well-suited to countries that lack sophisticated grid network telemetry. This initiative aimed to not only reduce peak demand, but also to defer capital expenditures as well as reduce reliance on non-renewable supply sources.

The Flex™ platform enabled TPDDL to notify customers about DR events, conduct measurement and verification, and then financially reward participants. The program grew from 2,000 customers to 100,000 in just three years, shedding just one megawatt (MW) of load at the outset with a projected 100 MW of load shed in the near future.

BDR programs can serve as a catalyst for VPPs, offering consistent load shedding without complex prerequisites or precursor technologies. To then grow the VPP by integrating other types of assets, it is wise to rely upon modular and scalable solutions such as Flex. This approach allows programs to scale-up in a logical and incremental fashion without program or onboarding delays. Another important lesson learned from this project is the value of timely measurement, verification, and financial settlement processes to enhance the customer experience, thereby attracting additional participants. Finally, no matter what type of customers one starts with on the VPP journey, scalable programs allow for diverse asset classes to enroll: VPPs should embrace the full gamut of possible DERs, ranging from C&I loads to rooftop solar as well as stationary and mobile storage, the latter being found in EVs.

The success of this program with TPDDL convinced Tata Power, its parent company and one of India’s largest integrated power companies, to also partner with Uplight to deliver clean, flexible capacity to Mumbai, India’s largest city. Launched earlier this year, this program aims to enroll 55,000 residential and 6,000 commercial and industrial (C&I) customers to reduce peak demand by 75 MW in 2023. By 2025, the program is expected to scale up to 200 MW of peak load reduction.

Conclusion: India Represents the Future

In April 2022, India became the nation with the most people in the world, surpassing China. This population growth highlights the leading role this country will play in the energy transition. The Indian energy landscape is evolving rapidly, driven by the need for peak demand reduction and cleaner energy sources on the supply-side of the equation. To help balance an increased reliance upon intermittent renewables such as solar and wind resources, demand flexibility will play a vital role. Our case study with TPDDL highlights the effectiveness of DR programs and their potential to jumpstart VPPs. As India’s energy demand continues to grow as its population surges, innovative solutions like these will be pivotal in building a sustainable and efficient energy future.