At the recent National Association of Regulatory Commission (NARUC) Summer Policy Summit, I saw up close the growing concern about grid reliability among state regulators, utilities and the industry at large. Electricity demand is expected to grow more rapidly with accelerated electrification across the building and transportation sectors. With increased frequency of extreme weather events, and the simultaneous retiring of aging fossil fuel power plants, an expected peak capacity shortfall can only grow over the next decade. Take New York, for example—a state with an expected peak capacity shortfall on the order of magnitude of ~450 MW.

As we strive to meet our carbon reduction goals in the most economically feasible way possible, NARUC and other stakeholders cannot overlook the substantial amount of capacity that distributed energy resources (DERs) are bringing to the table. This capacity is expected to grow nationwide, along with DERs’ potential to provide vital grid services to boost network reliability.

This blog explores the role digital solutions shaped by artificial intelligence (AI) can play in maximizing the opportunity for DERs under Federal Energy Regulatory Commission (FERC) Order 2222. Only when policy, regulations and advanced technologies are in sync will the transition to a decarbonized grid become truly viable. FERC’s July 28 announcement represents another step in the right direction, speeding up the interconnection of large grid-scale assets such as batteries as well as utility-scale renewable energy resources such as solar and wind farms. This move will allow these larger assets to be combined with aggregated DERs to help replace retiring fossil fuel peaker plants.

This issue is not limited to the U.S. The energy landscape worldwide has witnessed a remarkable shift toward a decentralized energy future with the proliferation of diverse DERs that include rooftop solar photovoltaics (PV), distributed battery deployments, electric vehicle (EV) charging systems, along with a growing list of smart appliances. Yet the U.S. is among the leaders in articulating what kinds of regulatory reforms will be necessary to create the decarbonized grid of the future.

Tapping DERs to make power grids more reliable is also not a new concept. For example, New Hampshire Electric Cooperative has been offering an interruptible water heater program since 1979. We must redefine our market structures to appropriately compensate DERs for providing grid services that can help reduce costs (for the utility, and therefore its customers), shift electricity to times when lower-carbon resources are available, and provide peak capacity desperately needed during both summer and winter peaks.

Technology always moves faster than policy, and regulations can lag even longer. To harness the full potential of DERs, regulatory frameworks need to catch up.

Empowering DERs to Solve, Not Create, Grid Challenges

The integration of DERs into the electricity grid offers numerous benefits, including increased grid resilience, reduced carbon emissions, and reduction of system costs—benefits that flow to both the energy provider and the ratepayer. However, the incumbent regulatory environment often limits the ability of DERs to participate in energy markets and realize their full potential value.

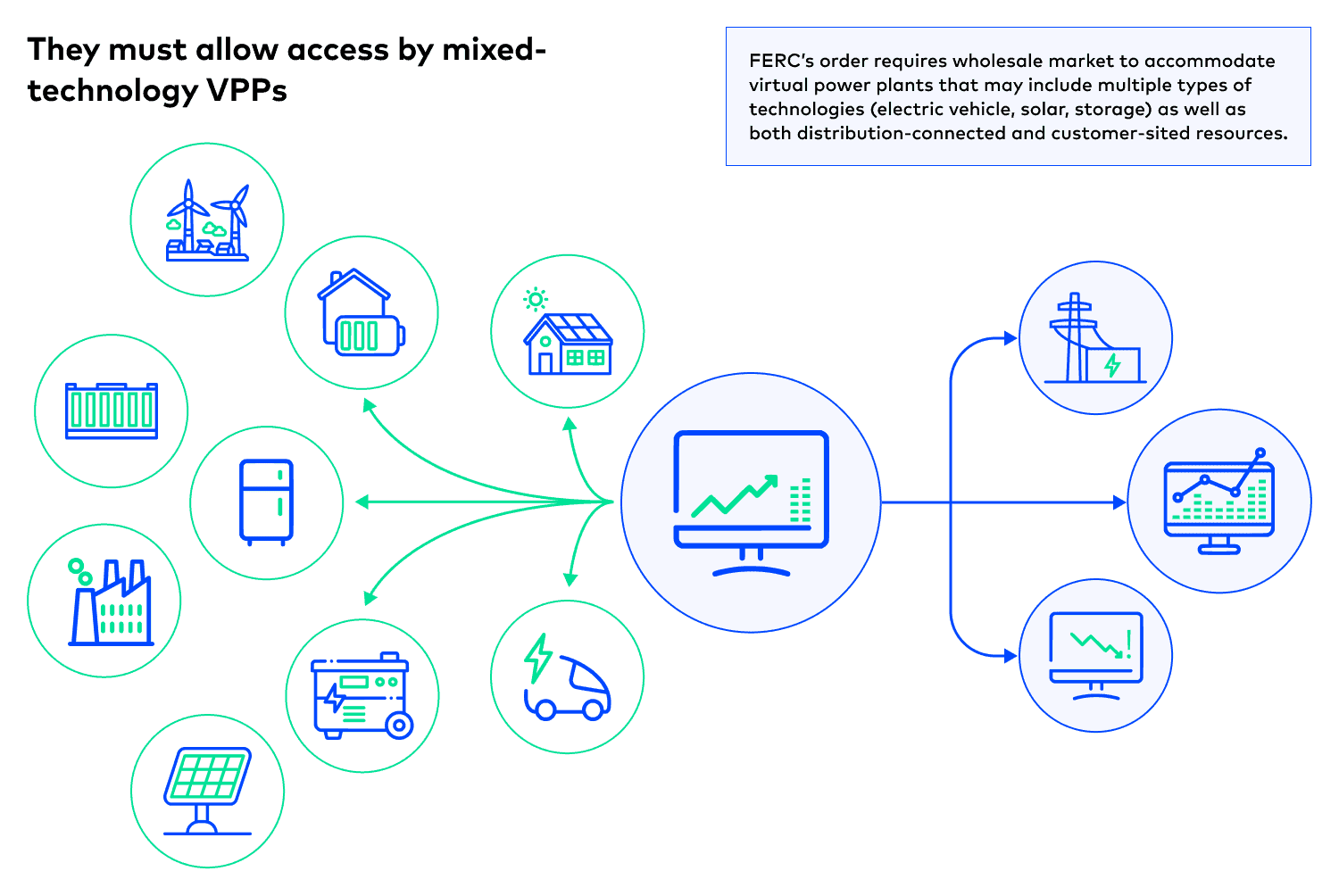

In September 2020, FERC issued Order 2222, a landmark ruling that aims to remove regulatory barriers and enable DERs to participate more actively in wholesale electricity markets. FERC 2222 requires Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs) to develop market rules that allow heterogeneous aggregations of DERs to participate in wholesale markets on a level playing field with traditional power plants

The goal of FERC Order 2222 is to bring organized markets managed by ISOs and RTOs into harmony while allowing each of them to retain their authority to regulate according to the unique characteristics of each regional market. FERC Order 2222 impacts approximately two-thirds of all U.S. consumers, with the notable exceptions of residents in Texas, the deep South, and Rocky Mountain states.

(Source: The Sustainable FERC Project)

In the past, DERs were limited to providing value at the distribution level of power service. This made sense when DERs provided such a small percentage of our overall energy mix. Yet the market structure that siloed retail markets from wholesale markets failed to accommodate the surge in reliance upon DERs for on-site consumption, which needed to be accounted for when calculating wholesale power supply needs and long-term capacity expansion planning. It also failed to allow for untapped DER capacity to provide value upstream. Regional markets began to allow for distribution-level resources to offset or defer transmission and distribution costs through non-wires alternatives (NWA), which remains a concept that has not quite left the classroom.

DER aggregations such as microgrids and virtual power plants (VPPs) can qualify as NWA projects, offsetting the need for expensive and time-consuming transmission and/or distribution system upgrades. Ideally, utilities would share more information around location of distribution deferral opportunities, the monetary value of NWAs, and actually implement more NWA projects to help manage infrastructure costs.

Perhaps the most noteworthy aspect of FERC Order 2222 is the ability of mixed DER aggregations as small as just 100 kW to participate in wholesale energy markets. Multi-asset DER aggregations are significantly more valuable—and reliable—than single-asset VPPs, as they have heterogeneous demand and supply profiles, which will help smooth out the amount of capacity that can be offered. This aspect of FERC Order 2222 has the potential of driving unprecedented decentralization and digitization of electricity.

FERC Order 2222: Three Paths Forward

While FERC 2222 sets the framework for DER participation in energy markets across much of the country, ISOs and RTOs have the responsibility to develop specific market rules and mechanisms that align with their regional resource characteristics and public policy objectives. As a result, these regional grid operators have adopted three primary approaches to DER regulation:

1. Performance-Based Approaches

Some regional transmission grid operators adopt performance-based criteria, where DERs must meet specific technical and operational standards to participate in the markets. This approach ensures grid stability and reliability while still allowing for DER integration and was implemented successfully for demand response and energy efficiency over two decades ago.

2. Market-Based Approaches

Other regional grid operators focus on DER participation driven by price signals and wholesale market dynamics. This approach promotes price transparency and competition, encouraging DER owners to offer their assets up for capacity or grid services based on real-time market conditions.

3. Flexibility-Based Approaches

A third model by RTOs emphasizes flexibility, allowing DERs to provide grid services and participate in markets based on their unique capabilities. This approach more explicitly acknowledges the diverse range of DER technologies available today – and their unique potential contributions to grid operations.

The Need for a Proactive DERs Strategy

FERC 2222 represents a significant opportunity as widespread adoption of DERs accelerates in the U.S., supported by other public policy measures such as the Inflation Reduction Act. These public policies are matched by equally transformative changes across the global energy landscape. The time is now for market participants in the U.S. to develop a proactive DERs strategy to stay ahead of FERC 2222 so that a broad swath of energy market stakeholders can fully leverage its potential benefits.

Here’s a step-by-step guide to maximize the short- and long-term benefits enabled by this trend-setting federal regulation:

- Proactively engage with policymakers and regulatory bodies to influence the development of market rules that align with the objectives of DER owners and operators. By actively participating in the rule-making process, industry players can shape regulations that facilitate DER integration, remove barriers for technical integration, and maximize their value propositions as market rules continue to evolve.

- Leverage innovative technologies like the Flex™ platform to manage and optimize DERs to provide value at both distribution- and transmission-level grid networks. By implementing advanced analytics, real-time monitoring, and surgical DER management capabilities, transmission grid operators and utilities can make informed decisions, improve grid stability, and capture the full value of DER participation in both retail and wholesale energy markets.

- Collaborate across the energy landscape with stakeholders that include transmission grid operators, public and private utilities, DER asset owners, hardware and software technology providers and environmental and ratepayer advocates. Establishing partnerships and sharing best practices can accelerate the adoption of DERs, streamline regulatory processes, and foster innovation in the energy sector. All of this cooperation is critical for the successful implementation of FERC 2222. For example, many lessons can be learned from Australia, where Uplight is managing a portfolio of behind-the-meter (BTM) energy storage assets providing frequency regulation.

Enabling DER Integration and Aggregation

Advanced energy management software plays a pivotal role in facilitating the successful implementation of FERC 2222. With its global footprint, innovative digital platform and new business models such as turnkey VPPs, Uplight empowers the full spectrum of market players to manage DERs in real time and unlock their full potential.

FERC Order 2222 marks a significant milestone in enabling the active participation of DERs in wholesale electricity markets. As regional transmission grid operators adopt different approaches to regulating and scheduling DERs for market participation, a proactive DER strategy becomes essential to seize the opportunities presented by FERC 2222. To drive the transformation towards a cleaner, more resilient, and decentralized energy future, we need to foster collaboration between policymakers. Through stakeholder engagements such as RMI’s VP3 initiative, Uplight can help ISOs and other grid operators navigate the energy transition by helping to figure out the ideal market designs that place DERs in the prominent place they deserve in solving today’s reliability challenges.

The nationwide peak capacity shortfall presents an urgent and potentially catastrophic challenge. We cannot afford to not tap growing DER capacity to the greatest extent possible. Now is the time to listen to stakeholders on how to effectively roll out FERC Order 2222 and to finalize corresponding regional market structure.