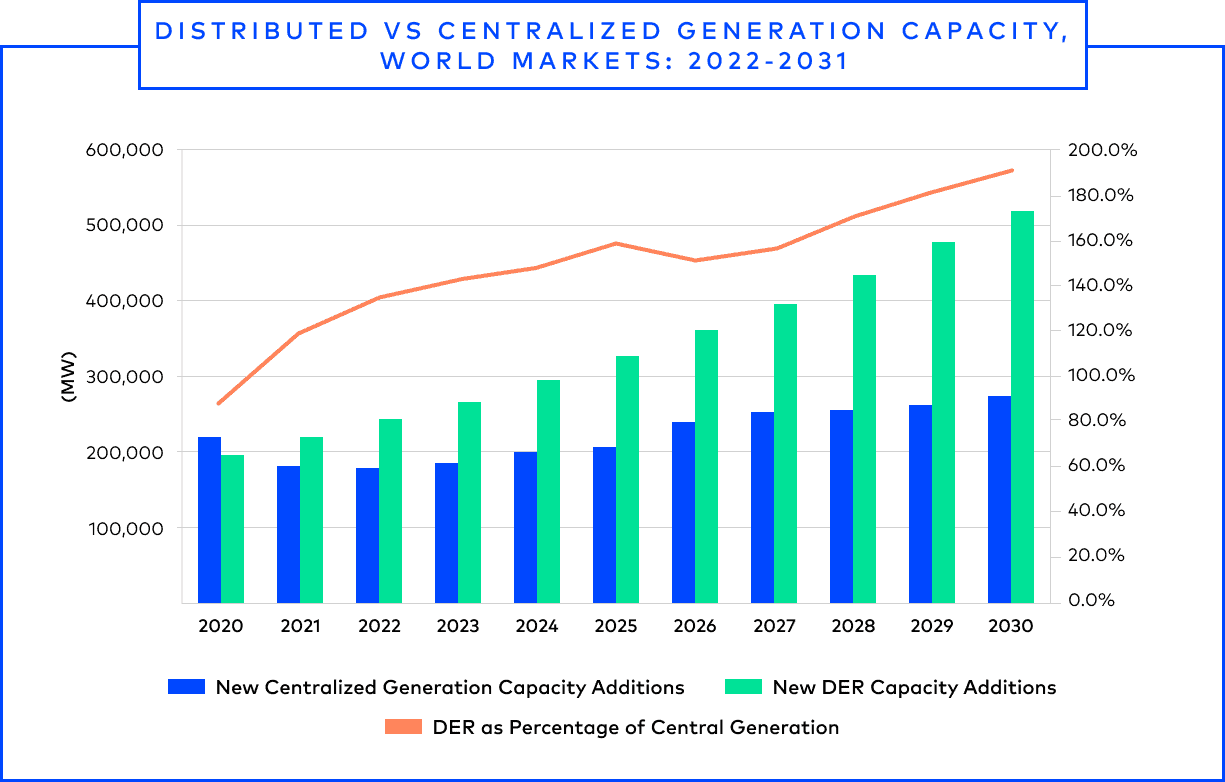

According to Guidehouse Insights, the amount of capacity being added to power grids globally from 14 different distributed energy resources (DERs)—everything from rooftop solar photovoltaic (PV) systems, electric vehicle (EV) charging, and a variety of other loads being converted into demand response (DR) assets–surpassed the new capacity coming online from centralized power sources such as coal or nuclear plants last year. The gap between distributed and centralized energy capacity additions grows over time in clear favor of DERs, highlighting the need for new grid infrastructure approaches that revolve around aggregating and optimizing these diverse, primarily prosumer assets in real time.

One clear market need that responds to this paradigm shift in global energy markets is a single go-to digital platform to manage this increasing diversity of DER assets integrated into utility distribution and transmission systems. It is also a clear indication that the boundaries between VPPs, DERMS, and microgrids—each a DER aggregation with a different primary purpose—are blurring.

The energy world is seeking AI-powered platforms to maximize the value of growing fleets of DER assets that offer immense challenges to utilities and other grid operators. Yet the ability to provide critical services such as resiliency in a more sustainable and affordable way is exactly what energy markets also need at this specific point in time.

Flexibility is the name of the game in this brave new world. Now more than ever, utilities, grid operators, and prosumers need digital flexibility management software to squeeze the most value out of DER fleets.

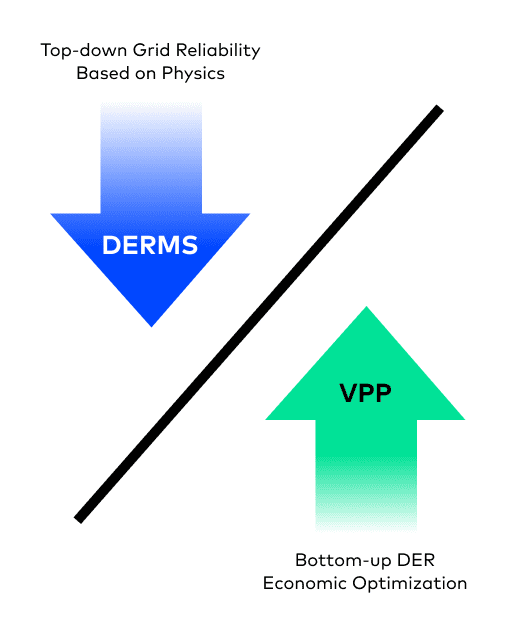

This article defines three primary DER digital platform use cases as the market moves closer to realizing important goals enabled by a continuum of aggregation and control solutions: economic efficiency (VPPs), grid integrity (DERMS), and resilience (microgrids.)

DER Platform Definitions

- Virtual Power Plant (VPPs) are systems that rely on software and a smart grid to remotely and automatically dispatch and optimize DERs. This technology involves aggregation and optimization tools, and often link retail to wholesale markets. VPPs are driven by market signals and pricing, and can address systemwide frequency variations.

- Distributed Energy Resource Management System (DERMS) are solutions to monitor, control, and dispatch grid-connected and behind-the-meter DERs across customer, grid, and market applications in real time. These DERs may be owned by utilities, customers, or third parties, and directly or indirectly controlled by the utility. Driven by need for active power optimization at the distribution level of electricity, DERMS can address voltage sags and surges on specific utility distribution feeders.

- Microgrids are groups of interconnected loads and DERs within clearly defined electrical boundaries that acts as a single controllable entity with respect to the grid. Microgrids can connect and disconnect from the grid so they can operate in both grid-connected or island mode. Driven by need for resiliency due recent power outage trends, microgrids can overlap with VPP or DERMS deployments.

Virtual Power Plants

Companies such as Uplight started out focused on load resources for utility DR programs and are meeting this need as their products and services evolve over time, accommodating greater quantities of diverse DER assets. Today, we creatively manage loads as grid resources at scale. For example, the company will be aggregating the loads of 1 million devices in real time in Hong Kong to help balance the grid in partnership with CLP.

Today, there are a growing number of multi-asset VPP vendors that keep expanding their DER management capabilities. The multi-asset VPP has become a necessary innovation to accommodate growing reliance upon DERs. With the help of VPPs, these temporary aggregations of load, generation, and energy storage can provide the same essential electricity services as a traditional centralized power plant if the right market rules and conditions exist.

VPPs are particularly valuable as displacements for fossil fuel peaker plants, often the most expensive and polluting of all possible electricity resources. VPPs can balance energy markets seeking to decarbonize supply while also helping policymakers refocus energy systems to become more democratic.

The concept of VPPs ushered in concepts, tools, and technologies that allowed DR providers to expand the reach of their controls to adjacent asset categories such as generation, energy storage, and EVs.

Utilities continued to view DER growth primarily from customer-sited, behind-the-meter deployments with heartburn. The growth in DERs often can translate into lower utility revenue and strand past investments in centralized utility power plants. Reliance on these new distributed grid assets utilities do not directly own or control raised concerns about the overall reliability of the grid. Despite deregulation, these utilities still hold the obligation to serve, a key tenet behind the original granting of monopoly status. They still need visibility into the assets interconnected to their distribution systems.

To maximize the value from these assets under a VPP framework where price signals facilitate the provision of grid service trading, a concurrent push for solutions occurred. This corresponding market need therefore revolved around ensuring the overall integrity of the distribution system. As DER assets increasingly provide value upstream to wholesale markets, digital controls and active power optimization are also needed to ensure overall grid reliability is not compromised by the sheer volume of transactions bridging what had been previously siloed retail and wholesale market transactions. Platforms that support both VPP and DERMS use cases can help utilities and grid operators address the myriad grid balancing challenges linked to rapid DER uptake on their systems.

The DERMS Use Case

Concerns about how the rapid explosion of diverse DERs would impact grid integrity led to the need for DERMS, a term often used as an umbrella for any platform focused on DER control and optimization, including both VPPs and microgrids. This overarching umbrella concept can also be described as an enterprise DERMS, rightfully implying it sits at the top of the pyramid of DER control strategies.

The components of a DERMS are not completely new. One could view the evolution of the DERMS as a natural outgrowth of a distribution management system (DMS). These systems must be integrated with and encompass traditional power flow and geographic information systems for accurate and acute system control. Despite the complexity of the DER integration puzzle, the goal is to bolster the grid’s reliability, not jeopardize grid performance. DMS as well as DR management systems (DRMS) are moving toward the broader DERMS framework.

Utilities, grid operators, and energy providers use DERMS to manage multiple DER types in a single system. Rather than relying on proprietary communication protocols for each vendor and device, DERMS rely upon common protocol standards to centrally administer all DERs on the grid. This construct saves the operator from having to manipulate multiple systems from multiple vendors for multiple device types, which would make DER management almost untenable from a staffing and operational position.

Microgrids

A microgrid is a small-scale version of the electricity grid that most consumers still rely on for power service today. Like today’s power grid, microgrids include a static set of generation facilities, distribution lines, and voltage regulators within a confined boundary. They can be networked with one another and the central grid to boost capacity, efficiency, and reliability. This networking could also transform multiple microgrids into a VPP. Microgrids can also function as autonomous islands of power whether connected to a utility network or not.

Microgrids differ from the larger grid in a few important ways. Their much smaller scale translates into far fewer line losses, since electricity is generated closer to loads. This, in turn, lessens demand on the utility transmission infrastructure, thereby increasing capacity to serve other loads. Furthermore, new controls, more efficient heat capture, micro-storage, and a variety of IT innovations decentralize and differentiate energy service provision within many microgrids in ways tailored to fit the unique customer needs and take advantage of locally available resources. In other words, instead of using a utility smart grid program to raise the level of homogenous power quality for all captive customers, microgrids offer the flexibility to provide heterogeneous power products and services to meet specific end-user needs and requirements.

This customized approach, nevertheless, can be expensive. To address this potential market barrier to microgrid deployments is the energy-as-a-service (EaaS) business model Schneider Electric has pioneered. This approach, which converts a large upfront capital expense burden to an ongoing operations and maintenance incremental expense, is now being adopted by other innovators throughout the microgrid ecosystem.

The success of no-money-down rooftop solar PV leasing programs to drive market adoption is compelling. Applying this model to microgrids does carry risk, however. A microgrid, which typically includes multiple DER types, is much more complex than a rooftop solar PV system. Multiple DER manufactured by multiple companies require a robust controls system that can deliver on performance guarantees on costs, performance and metrics such as emission reductions. The business model rides on the performance of the controls to manage complex interactions between assets each manufactured by different companies. Embracing increasing levels of interoperability is paramount.

Yet the future of microgrid EaaS business models will also increasingly bank on new revenue streams that can be captured by VPPs. Once a microgrid or cluster of microgrids sells capacity, energy, or grid services back to the utility grid or a wholesale market, it in essence becomes a VPP. One could also argue that a microgrid operated by a utility that incorporates prosumer DER behind-the-meter assets also becomes a DERMS.

Conclusion

As Federal Energy Regulatory Commission (FERC) Order 2222 opens up new opportunities for microgrids and other DER aggregations to participate in wholesale markets, the synergy possible with end-to-end microgrid/VPP/DERMS solutions is self-evident.

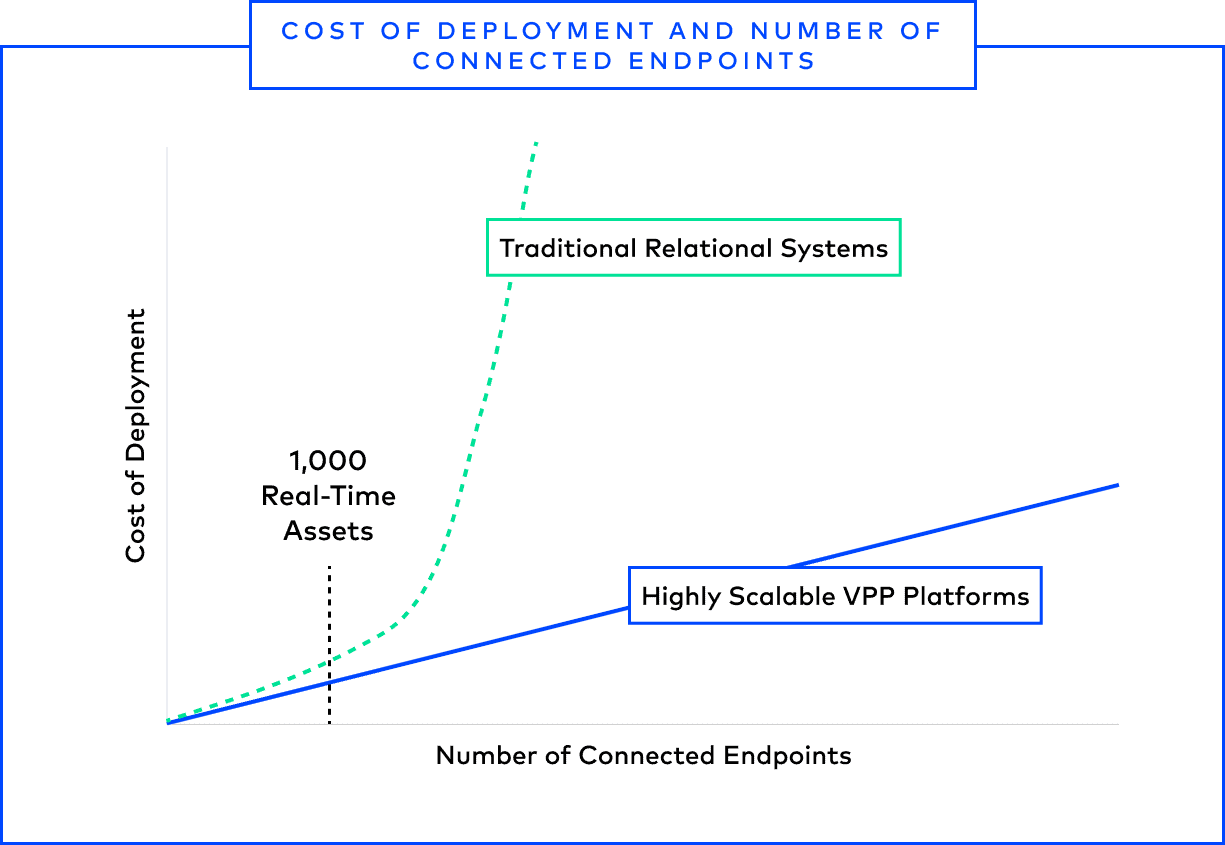

The key to market success will be scalability of these platforms to encompass greater numbers of assets of various vintages, manufacturers and sizes. This need for scalability spans the entire spectrum of digital controls. This aspect of DER management is a key differentiator. Combining the innovation with these digital controls, creative business models such as EaaS for resilient microgrids and the ability to span the entire spectrum of DER solutions speaks to synergies that energy markets around the world will need in the decades to come.