Cloud computing is ubiquitous. From sharing photos and streaming videos at home to online collaboration tools at work, the cloud powers it all. One recent forecast from IDC estimates that worldwide spending on public cloud services and infrastructure will more than double between 2019 and 2023.

Utilities are moving to the cloud too, and for good reason. Energy providers need serious computing power as more data starts flowing in from smart meters and grid management becomes more complex in an age of distributed generation resources and flexible demand. Uplight provides various cloud services to our utility partners, especially Software as a Service (SaaS), the biggest category of cloud computing spending according to IDC.

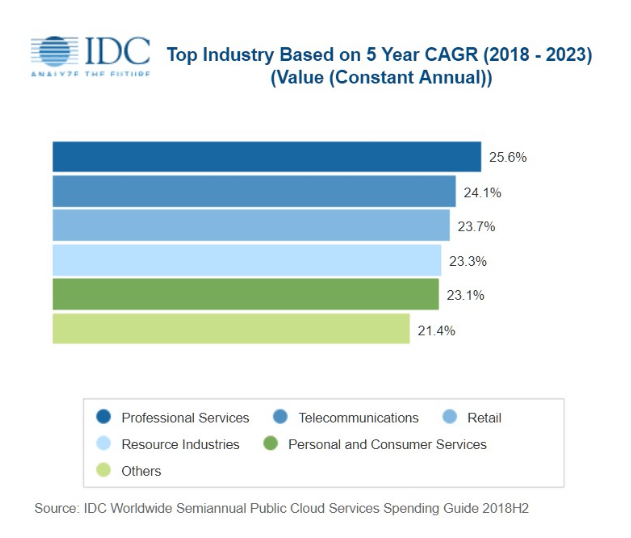

IDC estimates a 23.3% compound annual growth rate through 2023 in Resource industries, which includes utilities; however, the data indicate utilities will be slower to adopt cloud solutions than their peers in telecom, retail, or professional services. Why? The answer may lie in their regulated business model, which has historically rewarded utilities who build rather than buy IT resources. Several states are considering policy solutions that could place all IT investments on equal footing, whether they are “on-premise” or in the cloud. In doing so, those states could create a win-win-win for customers, utilities, and their shareholders alike.

IDC estimates a 23.3% compound annual growth rate through 2023 in Resource industries, which includes utilities; however, the data indicate utilities will be slower to adopt cloud solutions than their peers in telecom, retail, or professional services. Why? The answer may lie in their regulated business model, which has historically rewarded utilities who build rather than buy IT resources. Several states are considering policy solutions that could place all IT investments on equal footing, whether they are “on-premise” or in the cloud. In doing so, those states could create a win-win-win for customers, utilities, and their shareholders alike.

Why Utilities Think Differently About Cloud Computing

To understand the future of utility tech investments, it helps to understand their past. In the early days of the electric grid, policymakers decided to allow energy utilities to operate as monopolies. Monopoly utilities could achieve bigger economies of scale that would save consumers money, and given the dangers of running an electric or gas grid, it would be safer for all if there were fewer companies managing high voltage transmission lines, pipeline networks, and large-scale power stations.

How would these monopoly providers be motivated to continue building up the grid? Regulators decided to reward utilities for investing in capital expenditures (capex), long-lived physical assets like transmission and distribution infrastructure, pipelines, meters, and power plants—by enabling them to collect a set rate of return on this spending. This rate varies from state to state is determined by the local Public Utilities Commission, with average return on equity falling somewhere between 9-10%. By contrast, regulators decided that operating expenses (opex)—ongoing costs like fuel, maintenance, supplies and, indeed, SaaS and cloud computing—would not earn a return. Instead, they are treated as “passthrough” expenses, for which the utility recovers its cost from customers, but no more.

Although this business model was intended to encourage the original build-out of the electric and gas grid in the early 20th century, it largely persists to the present day. In an age of rapid innovation, it has created some unintended consequences. Or, as former Montana regulator and ex-NARUC president Travis Kavulla put it in American Affairs Journal: “Innovation and the utility’s profit motive are frequently misaligned.” Kavulla offers cloud computing as a prime case study of this phenomenon:

Consider cloud computing, for example, which is utilized typically through software-as-a-service (SaaS) offerings. In the [regulatory model] expressed above, this type of expense is recovered in utility rates—but not at a mark-up. An in-house software solution, meanwhile, is capitalized; a utility will earn a regulated return on this investment. Consumers almost certainly stand to benefit from SaaS. It relies on expertise which the utilities cannot hope to in-source; it is updated more frequently to allow it to synchronize better with the utility’s other technology such as meters and the devices which read them; and, for both of these reasons, cloud computing is usually more secure. But many utilities still tend to favor the in-house solution because their bottom line does not stand to benefit from the very attribute—its subscription basis that allows it to be nimble—which makes SaaS a clear winner.

Although this profit motive “misalignment” has not stopped utilities from making prudent investments in cloud computing and SaaS, it can be a deterrent. Regulators like Kavulla have noticed this unintended consequence of the legacy utility business model, and—though you’ll have to read Kavulla’s article to understand his prescriptions to fix it—some states including Illinois and New York have begun to take up the cloud/SaaS issue and are proposing solutions.

Innovation in Illinois

Policy change can take time; however, Illinois is undoubtedly furthest along in an effort to reconsider the regulatory treatment of cloud/SaaS solutions. In 2016, the Illinois Commerce Commission launched a Notice of Inquiry to gather comments from utilities and stakeholders about the issue. The result was an in-depth report from staff and an order recommending a formal rulemaking to specifically address the cloud computing issue.

Prior to this Notice of Inquiry, many Illinois stakeholders were not familiar with cloud computing or SaaS solutions, so this was a hugely important effort in simply defining the terms of the discussion. Through the process, stakeholders and Commission staff raised important questions regarding cybersecurity, cost to consumers, and benefits to utilities and their customers.

If reading through regulatory documents is not your cup of tea, suffice it to say that the ICC’s report acknowledged that regulatory accounting rules “have not kept pace with technological innovation,” leading to disparate treatment for on-premise and cloud solutions. Just last month, the Commission revisited the matter, hearing public comments from a variety of stakeholders, vendors, and utilities about their perspectives on the treatment of cloud and SaaS investments and could be moving toward a finalized rule soon. The ICC will certainly be watched closely by other policymakers who see the same trends across the industry.

New York REVs Up

New York State has also been a hotbed of utility innovation with Governor Andrew Cuomo’s comprehensive energy strategy program, Reforming the Energy Vision (REV), spurring utilities to explore cutting-edge clean energy technologies. Recognizing that many of these advanced energy programs will require software and computing solutions that utilities could acquire from outside vendors more quickly than they could build them internally, New York Public Service Commission issued a declaratory order that enables utilities to capitalize software procured as a prepaid lease.

The concept of a level playing field seemed to be top-of-mind for the Commission in the 2016 order: “As utilities evaluate whether to purchase or lease these applications, their ability to earn a return on a portion of the lease investment should help to eliminate any capital bias that could affect that decision.”

Options for the Cloud: No ‘One-Size’ Solution

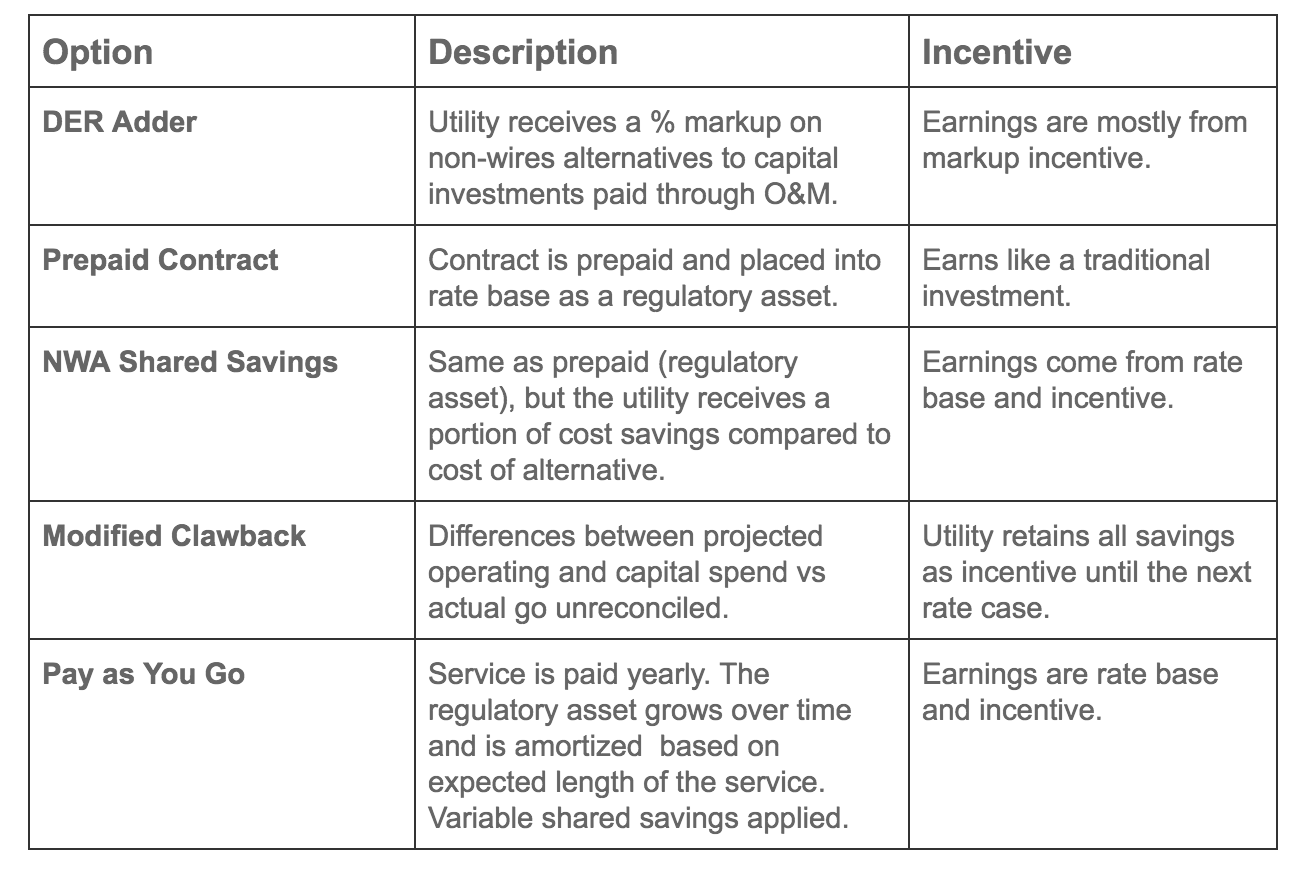

If the emerging consensus is that cloud computing is the future for utilities, how can regulators enable it? There are many models. Helpfully, Advanced Energy Economy Institute walked through at least five of them to inform policymakers on their options in their 2018 report Utility Earnings in a Service-Oriented World. These options are summarized in the table below:

Source: AEE

Some of these options will spur immediate investment through clear near-term incentives; others encourage utilities to innovate their way to greater earnings over time. The challenge for regulators appears to be selecting the best model for their particular jurisdiction or the objective the utility is looking to achieve. Some caution is warranted here. An over-determined approach may leave value on the table for consumers.

Since the applications in the cloud are numerous, there is not a “one-size fits all” solution. For that reason, regulators should consider allowing multiple options for utilities to choose their own path to the cloud, based on the needs of their system and their consumers. Like all utility spending, these capitalized cloud and SaaS budgets would still go through rigorous prudence reviews to ensure that customers get the most out of every dollar spent.

Incentives Can Level the Playing Field

Ultimately, incentives matter to any business, but to a regulated utility, they are essential. As Kavullla notes, the utilities’ profit motive must be in line with its investment objectives. When these two elements are out of line, there is inevitably friction between regulators, utilities, their customers, and their shareholders, who will always push for higher returns.

In the case of cloud computing, the interests of all these groups can be served. Regulators increasingly recognize the cloud is the future for all businesses, utilities included. Utilities are proposing innovative programs that require cloud and SaaS resources to be cost-effective. Customers are demanding ever more responsive and tech-enabled solutions, since we are all so familiar with them in our home and work lives. And shareholders want utilities to be rewarded for making savvy investments.

Putting cloud computing on a level playing field with utility-owned IT will encourage utilities to join their Fortune 500 peers in the cloud revolution, and utilities should be given clear, strong incentives to make the move. States like Illinois and New York are leading the way, and undoubtedly, more will follow their path to the cloud.