The opportunity for virtual power plants (VPPs) markets is huge. DOE predicts, for example, that VPPs could serve 20% of peak load and save $10B in annual grid costs by 2030 by displacing traditional (peaker) generation.

Moreover, as numerous market observers have pointed out (see here, here, and here), VPPs will be an essential part of the energy solution (along with more T&D and better interconnection policies) as we proceed down the energy transition path. In other words, if we are going to continue retiring coal assets, increasing renewables, and pursuing decarbonization targets (as we should!)–while simultaneously maintaining the integrity of the grid (as we must!)–then we need more demand flexibility. Enter VPPs.

The buzz is merited. Here at Uplight, we believe that the most exciting part is the potential for residential VPPs because they provide the aforementioned grid and societal benefits while also offering everyday consumers a means to get paid. Let’s hear it for democratizing the energy system.

Residential VPPs offer us a bold and beautiful vision, but like most things in the electricity industry: making it happen just ain’t that simple.

For residential VPPs to scale, three big ingredients need to be combined in the energy ecosystem:

- Proven technology solutions that can automate and optimize residential loads in response to price signals.

- Great customer engagement to engage and aggregate residential customers.

- Stable and effective policy that enable residential VPPs to thrive.

Solutions for the first two ingredients already exist. It’s #3, robust market development policies, that requires attention to effectively scale up residential VPPs.

The following describes how the right technology, customer, and policy solutions can ensure that we deliver on the full promise of residential VPPs.

The Importance of the Residential Sector to Peak Demand

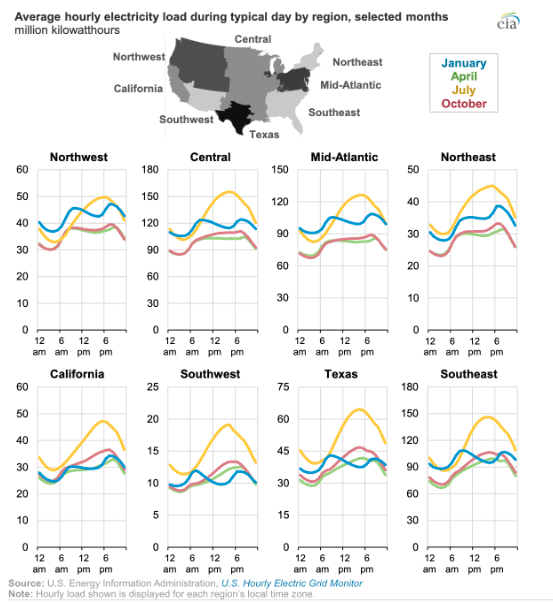

First, why focus on residential VPPs? In the US, residential customers make up 40% of electricity consumption, a larger share than the commercial, industrial, or transportation sectors. In aggregate, residential customers also have outsize impacts on the grid. For example, in most regions, the residential sector has a disproportionately high impact on peak demand due to summertime use of air-conditioning. This is demonstrated below in July’s yellow peaks in every region.

As the US Energy Information Administration (EIA) reports:

Air-conditioning equipment is used in 87% of homes in the United States. During the middle of summer, air conditioning accounts for a large portion of residential and commercial electricity usage. The daily U.S. load cycle in the summer has a much wider range than in the winter because of the widespread use of air conditioning.

In the future, as heat pumps and other electrification technologies are deployed, many regions expect to shift from summer peaking to winter-peaking. In the winter peaking scenario, we also expect the residential sector to have an outsized impact as residential customers shift from natural gas/propane/oil to electric heating.

In regions like Texas, which already have a high penetration of electric heating, we see wintertime peak demand impacts intensified during extreme weather events, meaning that residential load flexibility is also critically important to manage grid resiliency.

What’s the takeaway? To cost-effectively manage summer and winter peaking events, especially as the U.S. grid faces greater stress from extreme weather events, it is critical to use all the tools in the toolbox, especially those that enable the residential sector to aggregate DERs and create VPPs.

The First Two Ingredients to Scale Residential VPPs

Let’s start with the easier (though by no means easy) ingredients for residential VPP success: (1) proven technology solutions and (2) great customer engagement.

First, have we solved the technology problem? The answer to this question is “yes, mostly.” As an energy community, we have done a lot of the hard work already. We have largely digitized the energy economy via smart meters, smart thermostats, and other smart DERs. Moreover, as DOE notes in its Pathways to Commercial Liftoff Report, “VPPs are not new and have been operating with commercially available technology for years.” In other words, we’re not waiting for a new technological breakthrough to optimize and automate flexible residential capacity in response to price signals. We can do it today. Of course, there are continual improvements that technology vendors can and should make to products. But by and large, we’ve got it handled.

Second, have we solved the customer engagement problem? This one is important, because unlike the C&I sector, residential VPPs require aggregation of a lot of small loads. This requires technology vendors to engage many, many (relatively unsophisticated) customers and keep them happy enough to participate in programs, while also aggregating, shaping, and shifting enough load from customers’ energy devices to be meaningful to grid operators. It just plain won’t work if we cannot provide a frictionless customer experience.

As discussed before, we already know how to create this customer VPP experience (see here and here and here for more). The short answer is that we work with utilities to implement a connected customer journey, which is a low-friction engagement and activation process from initial customer outreach through to installation and orchestration of energy systems. It consists of:

- Customer education: providing customers with the information and recommendations they need to make smart energy choices (via online energy portals, coordinated outbound messaging, etc.).

- A simplified buying journey: consolidating multiple steps of the buying journey into one action via a central online marketplace (e.g., product information, rebate processing, qualification, program enrollment, etc.).

- Meeting customers at their preferred (non-utility) buying channel: extending the customer journey to include non-utility channels (e.g., online vendors, big box stores), thereby increasing customer accessibility to utility rebates, services, and products.

- Helping the customer take the right next step: matching the customer to the full suite of energy products and services (e.g., energy efficiency, electrification, demand response, time of use/dynamic rates, etc.) to help them take the right next step when they’re ready.

So if these issues are solved, what do we need to do to scale the residential VPP market?

The Third Critical Ingredient: Supportive Market Development Policies

Notably, to date, little of substance has been written on the comprehensive market development policies necessary to scale up residential VPPs. Instead, market analysts tend to make general observations about the need to open up wholesale markets to VPPs (i.e., FERC 2222), policies to support greater DER deployment, and the medium-to-long-term opportunity for retail distribution system operators (DSO).

While these issues are important, suffice it to say we have not established a coherent policy framework for residential VPPs. As a result, challenges abound. For example, the NY ISO has proposed a 10 kW asset minimum for wholesale aggregations, which effectively rules out residential VPPs. Not enough utilities are designing cost-effective retail VPP programs, as recently evidenced by the Proposed Decision for California’s DR proceeding. And the concept of a DSO, which could be a game-changer for residential VPPs, is in its infancy.

To keep things simple, I boil down the most important near-term policy and market development requirements to four areas, which policymakers and regulators could address over the next one to two years to scale up the residential VPP market.

- Require robust utility planning: Regulators should require greater planning for grid flexibility. This includes requiring utilities to develop load flexibility studies, which assess the technical, economic, and market potential of load flexibility. In addition, state legislatures should require Commissions to set demand flexibility standards, which establish VPP capacity minimums (e.g., set as a percentage of peak load). Doing so will provide greater certainty to utilities and third parties on the growth path of VPPs.

- Align financial priorities: Regulators should align utilities’ financial interests with VPPs. Specifically, Commissions should establish performance-based regulations that incent utilities to deploy VPPs just as they are incented to build poles and wires. Specifically, VPP regulations should allow utilities to earn an equivalent rate of return on the VPP or demand flexibility resource as the capital investment that otherwise would have been needed to fulfill the need.

- Enable value stacking: Regulators should enable utilities to stack the benefits of VPP across the wholesale and retail markets. Market rules need to be in place that permit VPPs to be compensated at the same rate that a supply resource would be compensated for the values it generates including avoided capacity costs, avoided energy costs, and ancillary services. It also includes deferred transmission and distribution costs, avoided emissions, and resilience value.

- Build confidence: Grid operators need to build confidence in VPPs via proven M&V. Some experts indicate that grid operators discount capacity offered by demand flexibility solutions by 30-50% because they lack the confidence that the capacity will show up as promised. As an industry, we should do everything we can to increase grid operators’ confidence. Specifically, we need agreed-upon M&V approaches for multi-DER systems that are applied across jurisdictions. We additionally need data-sharing agreements to ensure we can measure VPP impacts in a timely manner.

Notably, most of the policy solutions described here are not costly to implement. The main cost is in investing the time and energy to create market rules, set targets, stand up programs, and align stakeholder interests.

What’s the Outlook?

If we get these policy and market development issues right, we (as an energy community) have a real shot at achieving, or even exceeding, the projections that DOE laid out in its Liftoff Report.

If we don’t, then we will almost certainly end up paying too much for the energy transition.

It is thus imperative for our energy community to establish a robust policy framework and implement the policies and market mechanisms needed to facilitate greater deployment of residential VPPs. Making VPP investments now will reduce ratepayer costs and accelerate the energy transition over the medium term.