Buzzwords are popping up in the new energy landscape, and chief among them is the term virtual power plant (VPP). While no official government or industry definition exists today, here’s what I came up with about a decade ago:

A VPP is a aggregated system of energy assets remotely and automatically assembled and optimized by a software-based platform to dispatch services for distribution or wholesale markets.

In 2012 one of the first report on VPPs for Guidehouse Insights (then Pike Research) said: “Virtual power plants represent an ‘Internet of Energy.’” The entry goes on to state, “These systems tap existing grid networks to tailor supply and demand services for a customer. VPPs maximize value for the end-user and distribution utility using a sophisticated set of software-based systems. They are dynamic, deliver value in real-time, and can react quickly to changes in customer load conditions.”

Since then, VPPs have morphed and matured and can now be found in nearly every part of the globe. Back in 2012, most VPPs did not include energy storage whereas today, storage is often viewed as a fundamental building block. As deregulation trends deepened, the focus for VPPs turned to the daunting task of integration of distributed energy resources (DERs) into wholesale markets, where related terms such as distributed energy resource management system (DERMS) and microgrids emerged.

Tracing the evolution and history of VPPs provides important context. Read on to find out how they work, and why they are needed today more than ever.

The History of Virtual Power Plants

Virtual power plants are becoming a popular solution to provide flexible and efficient ways to balance wholesale markets marching toward net zero carbon supply portfolios. The idea behind VPPs is to combine capacity from several sources, including demand response reductions, renewable energy sources, energy storage systems, and even traditional energy sources, to form a virtual resource that operates like a single entity but which is composed of potentially thousands (if not millions) of individual resources.

Where Was the First Virtual Power Plant Installed?

Unlike the U.S., which started on its VPP journey with early demand response (DR) programs, Europe began with integration of variable renewables. The German utility RWE claims to have enacted the world’s first VPP back in 2008. The utility aggregated the capacity of nine different hydroelectric plants ranging in size from 150 kW up to 1.1 MW, initially, totaling 8.6 MW of VPP capacity.

This aggregation opened new power marketing channels for these relatively small facilities. These pathways to market would not have been viable if these assets were still operating as standalone systems since contract commitments for delivery could be more easily met if the small facilities responded as a pool of hydro resources rather than individual units. The VPP later expanded to include biogas, backup generators, combined heat and power (CHP) and wind turbines to reach 200 MW in size today.

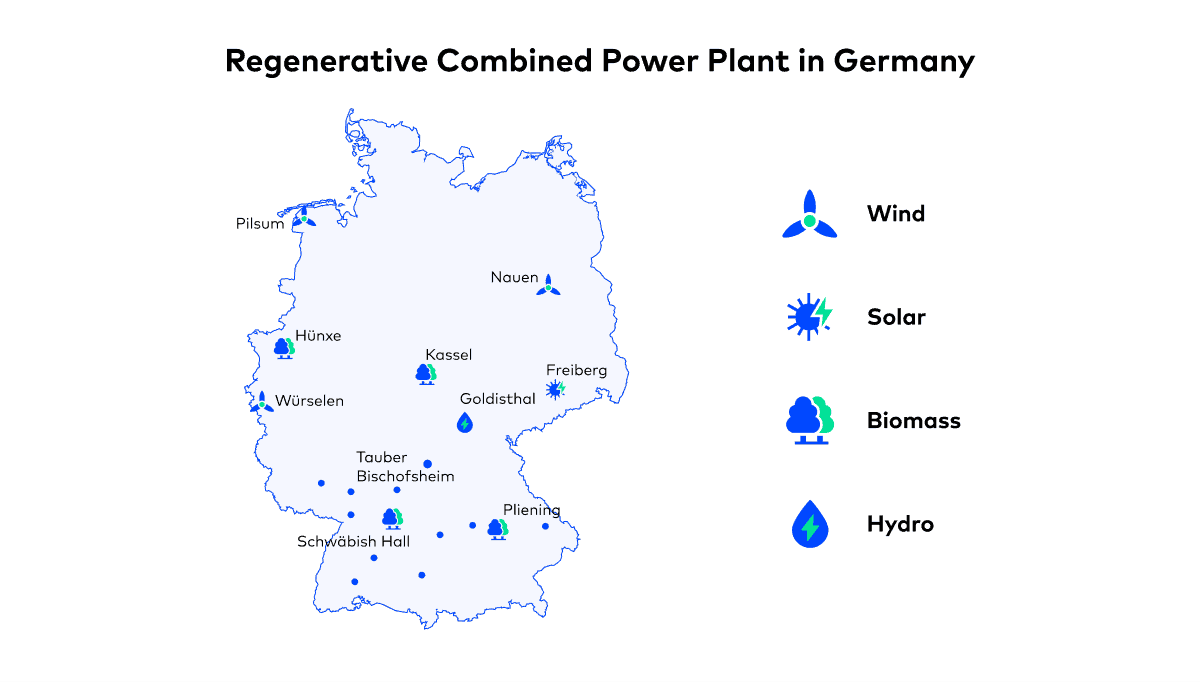

Another pioneering VPP emerged in Germany a few years later in the form of the so-called Regenerative Combined Power Plant. The Fraunhofer Institute touted this experimental VPP as proof that a country as large as Germany could rely completely on renewable energy resources for its power supply. A total of 36 wind, solar, biogas, CHP and simulated pump hydro resources could be operated as a single power plant and supply 24/7 electricity to the equipment of 12,000 households. A revision of feed-in tariffs for distributed renewables, and a spot market for excess capacity, allowed VPPs to become more commercially viable in Germany today.

In the U.S., VPPs started with demand response (DR), and accelerated with the emergence of smart grid initiatives funded by the Obama Administration in 2008—the same time VPPs were getting off the ground in Europe with renewable energy management experiments. These public investments from the American Recovery and Reinvestment Act (ARRA) program in Advanced Metering Infrastructure (AMI) and related smart grid technologies were key enabling technologies for VPPs.

By collecting real-time data on energy use and demand, utilities were able to optimize energy usage and reduce peak demand by incentivizing customers to shift their usage to off-peak hours. The next logical step was to use this same technology to manage multiple types of DERs and use them to balance the grid with the help of emerging technologies such as artificial intelligence (AI) and machine learning (ML), techniques that have been integrated into our Flex™ platform.

Multi-Asset, Multi-Market VPPs

The next evolution of VPPs embraced the diversity of DER assets populating the world’s grid networks. As long as an asset—whether generation, load, or energy storage—can be sensed and controlled, it is an eligible resource to be rolled into a VPP. The list of DER assets keeps growing longer, with electric vehicles (EVs) being the latest addition to VPP optimization.

Market structures are vital to allowing such state-of-the-art VPPs to be commercially viable. In the U.S., for example, different jurisdictions feature different rules, with many VPP markets piggybacking on DR programs that sometimes work for VPPs, but sometimes don’t.

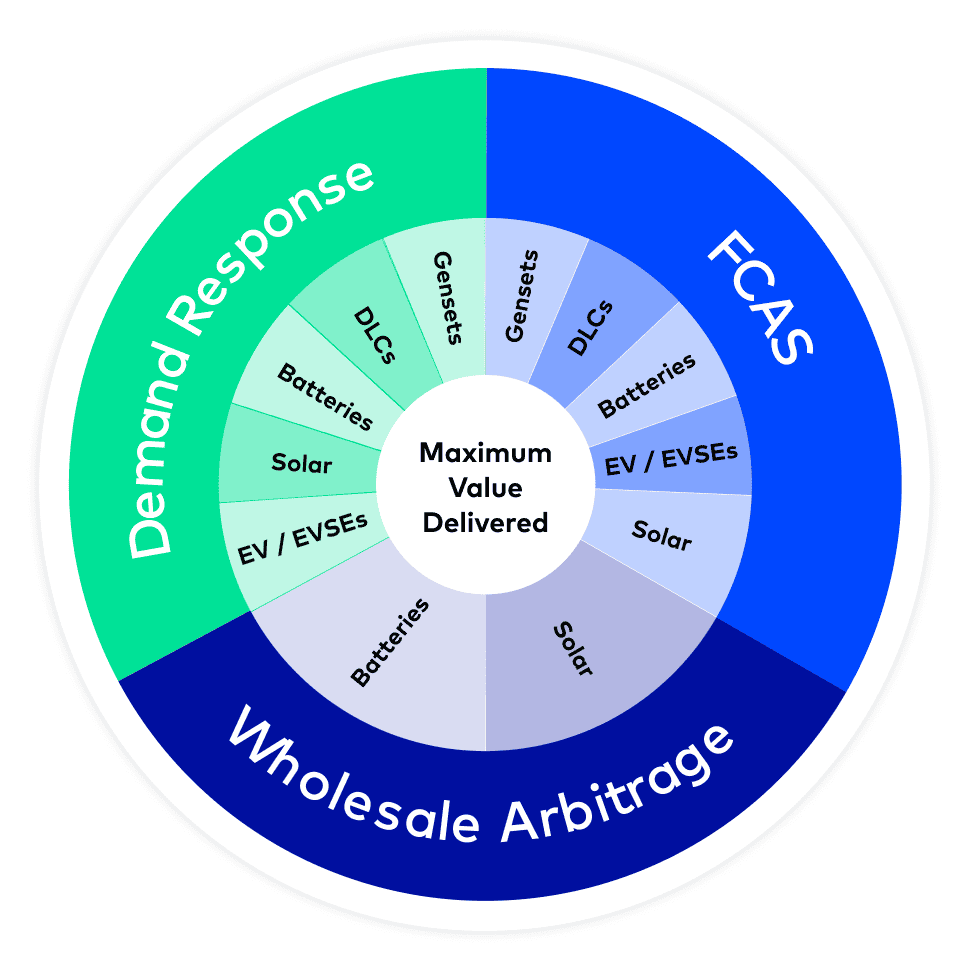

VPP Optimization and Mixed-Asset DER Adoption in Australia’s Wholesale Market

The five-minute wholesale settlement market in Australia results in a hyper competitive bidding process that sets the stage for energy retailers and other market participants to fully embrace the VPP market optimization opportunity. The Australian market is an energy-only market lacking a capacity or day ahead market. Trading activity can be frenzied and the key to market success is working with the right digital control platform. Bidders can sell into six frequency services market products as well as eight grid service markets. A battery can be allocated almost 20 different ways, with compensation spanning almost a dozen different pricing bands.

The complexity of the Australia market is giving rise to the latest mutation possible within the DER management ecosystem: mixed asset, multi market VPPs. This new market structure will accelerate adoption of energy storage devices, a key buffering technology which has emerged as a vital component to state-of-the-art VPPs. And while adoption of EVs is remarkably low in Australia—representing less than 1% of total vehicle sales by one estimate—these market reforms set the stage for EV assets to be bundled together with rooftop solar photovoltaics (PV), batteries, and large industrial loads to create portfolios of aggregated flexibility that Australian market participants will increasingly rely on in the future.

3 Types of Grid Services in Multi-Asset VPPs in Australia

The illustration below shows the types of DERs that can be integrated into multi-asset VPPs and the three primary wholesale markets they can sell into in Australia.

- Demand response helps reduce demand peaks without relying upon polluting an expensive fossil fuel peaking plants.

- Frequency control ancillary services (FCAS) fine tunes the frequency of the grid to keep it in balance.

- Wholesale arbitrage allows asset owners to maximize revenue streams pegged to wholesale market price fluctuations.

Emergence of New VPP Business Models: Turnkey VPPs

Federal Energy Regulatory Commission (FERC) Order 2222 allows for aggregations as small as 100 kW of mixed DER portfolios installed at the retail distribution level to sell into transmission wholesale markets.

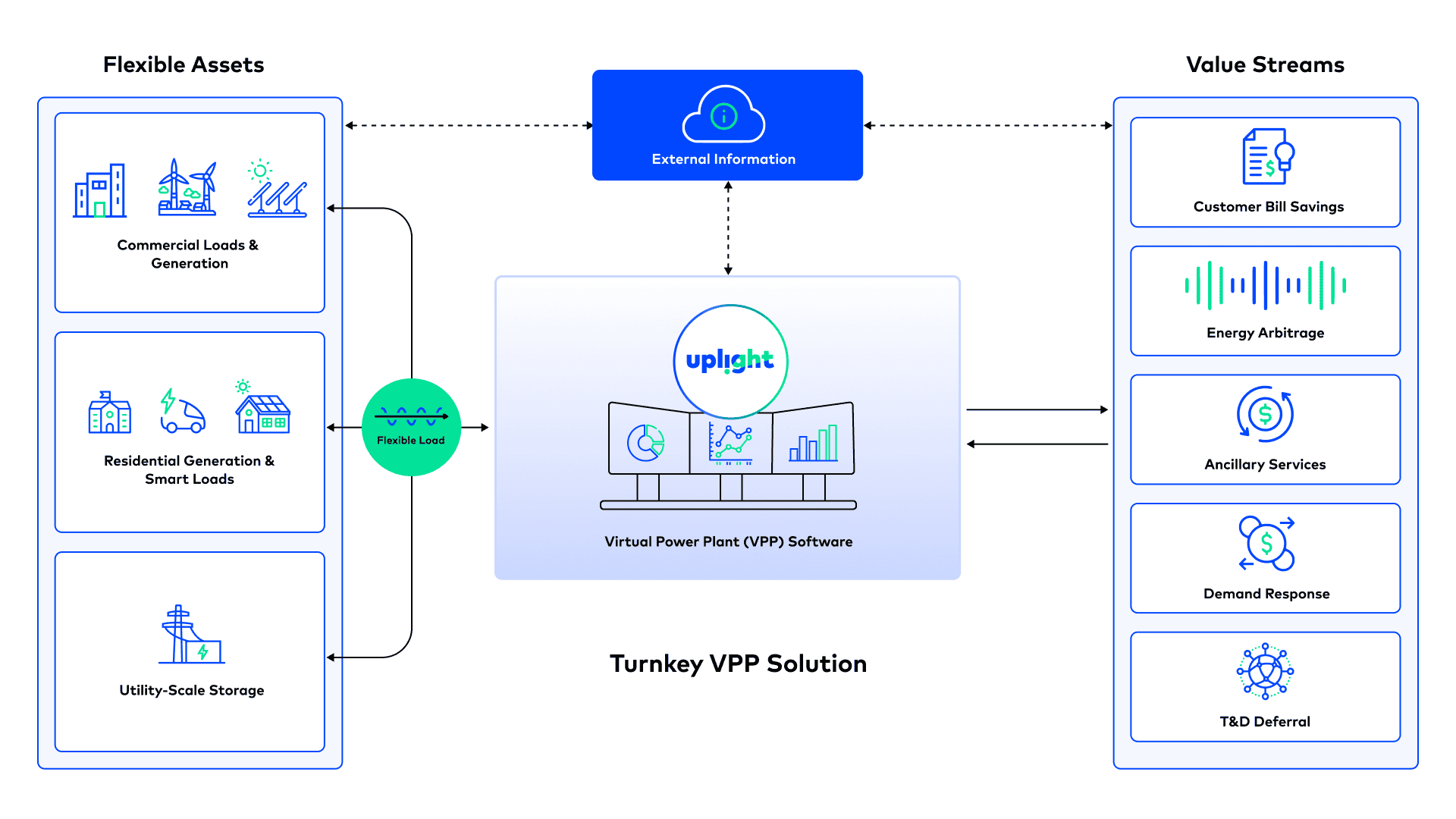

With the use of advanced algorithms and data analytics, VPPs are able to optimize the energy mix and ensure that energy is delivered when and where it is needed. The Flex platform provides comprehensive and flexible tools for VPP management that can be tailored to meet the specific needs of each energy provider.

Overcoming Regulatory and Cost Challenges with Turnkey VPPs

One of the challenges for deploying VPPs is the lack of standardization. The energy industry is highly regulated, and many different regulations and standards must be met in order to ensure the safe and efficient operation of VPPs. We’ve addressed this challenge by providing a comprehensive and flexible solution designed to meet the needs of a wide range of energy providers. With its cutting-edge technology and data analytics capabilities, Uplight is helping energy providers to overcome regulatory barriers and achieve their energy goals.

Another challenge facing the growth of VPPs is the uncertain costs associated with developing and deploying these systems. We’ve addressed this uncertainty by offering a turnkey solution that helps energy providers to quickly and easily deploy VPPs. This solution is designed to be scalable and cost-effective so energy providers can quickly achieve their energy and sustainability goals.

Decentralized and Digitalized Resources Underpin Turnkey VPPs

Utilities can now contract for VPP capacity like any other resource. Rather than rely upon the vagaries of DR, where participation rates can vary and often decline over the course of a year due to participant fatigue, the turnkey VPP offers a compelling way for utilities to obtain firm capacity from decentralized and digitalized resources with lower carbon emissions. This solution covers the complete lifecycle of a VPP: program design, customer enrollment and engagement, operations and maintenance, delivery, and settlements.

Our first customer turnkey VPP customer was the Clean Power Alliance (CPA), the largest community choice aggregation (CCA) program in California with over 3 million customers. This turnkey VPP started with 6 MW of demand-side resources, including modulating EV charging, to reduce peak capacity often provided by fossil fuel peaker plants in the past. CCAs such as CPA are expected to provide the majority of electricity to the customers of the state’s three largest utilities within the next few years.

Virtual Power Plants Are the Future of Energy

Virtual power plants open the door to tremendous opportunities to reduce economic and environmental costs, embrace efficiency, and leverage energy assets that often have already been paid for. As the energy landscape continues to evolve, the deployment of VPPs will become increasingly important. With their ability to integrate various energy sources, VPPs are helping to create a more flexible and efficient energy system. And as the growth of VPPs continues, the potential benefits are great, too.

In the last year alone, 600,000 devices in Hong Kong contributed to a VPP that provided 300 MW of capacity when it was needed in real time. Similar successes are occurring in countries as diverse as Japan, Australia, France, and India, and in many states throughout the US. VPPs are no longer an esoteric concept explored by government agencies and research institutions. They are active in markets worldwide today. The only things holding them back are outdated regulations and resistance from some incumbents and even some new energy market participants.

The trend is clear. VPPs will be the glue that holds the grid together in decades to come as the world relies increasingly on diverse DER assets. They are part of the decentralized, digitized and decarbonized energy system of the future. We can only reach 100% renewables if we harness the flexible capacity of the world’s DERs.