The Inflation Reduction Act (IRA), signed into law last week, is a boon for virtual power plants (VPPs)–a term commonly used to refer to the ability of digital software platforms to aggregate and optimize distributed energy resources (DER) through the use of artificial intelligence (AI). Though the bill is wide-ranging and addresses health care and federal deficit reduction, the most transformative impact this legislation will have is clearly on reducing the threat of global climate change.

Why is the IRA the most significant piece of environmental legislation in decades? The total amount being invested—$360 billion over the next decade—to slash greenhouse gas emissions 40 percent by 2030 is the largest commitment to climate change mitigation in U.S. history.

While investments in the environment were once viewed as a cost rather than a benefit for consumers, it is estimated that when fully enacted, this legislation will save U.S. consumers between $170 and $200 billion annually. Read on to learn why this legislation is great news for VPPs, a platform that converts DERs from grid management problems into cutting-edge solutions.

VPPs Represent a Bottoms-Up Approach to Climate Disruption Solutions

Due to the recent Supreme Court ruling limiting how the federal Environmental Protection Agency (EPA) can regulate emissions contributing to climate change from large centralized power plants, the new IRA takes a bottom-up rather than a top-down approach to achieve the innovation necessary to respond to the climate change threat. The law will allow consumers to be transformed into prosumers thanks to a series of tax credits and other incentives allowing them to make their homes and businesses vital solutions to the climate change conundrum. This, in turn, will create a pool of DER assets that can be intelligently managed to bolster grid reliability without the need for fossil fuel peaker plants to fill in the gaps when the sun doesn’t shine or the wind doesn’t blow.

Through government incentives, the IRA legislation is really geared toward lowering the cost of a long list of smaller, cleaner and smarter technologies, all designed to make it easier for consumers themselves to respond to climate change.

The new law never mentions VPPS—but the impact it could have in supporting and growing a diverse mix of distributed energy resources (DER) that underpin VPPs is undeniable.

If harnessed with the right DERMS platform, DER assets that include new electric loads, generation, and energy storage can create a more resilient and sustainable grid network either through real-time management or creative scheduling. Other VPP options also include turnkey VPP services being deployed in California and around the world that deliver capacity and energy directly to utility grid networks from this same set of DER assets.

Planting Seeds for Future VPPs

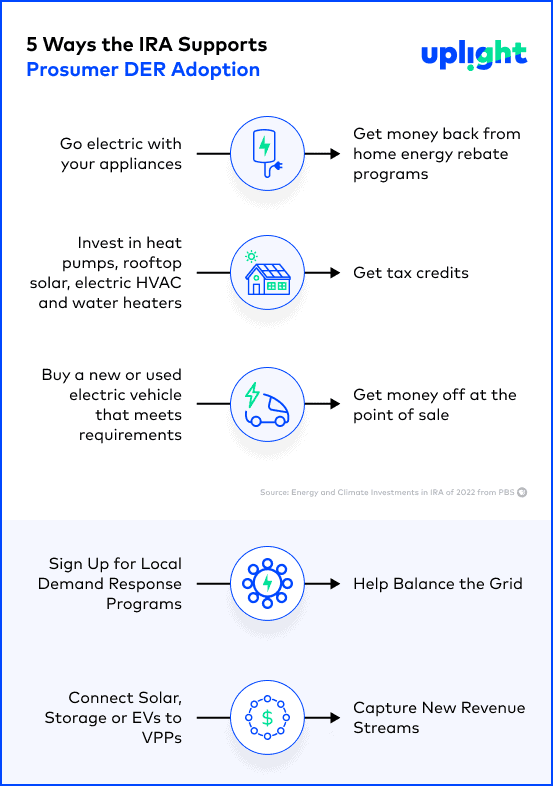

Here are some selected highlights from the IRA legislation most relevant to the development of future VPPs since building loads, on-site generation and energy storage, and electric vehicles can all be rolled into VPPs that can displace the need for large, centralized, and polluting power plants:

- $9 billion for home energy rebates to help consumers electrify their home appliances and energy-efficient retrofits, with a focus on low-income consumers. The resulting electricity loads can be converted into grid assets with the right kind of software and market structures. Such loads are being integrated into the Clean Power Alliance (CPA) VPP in Southern California. CPA is the state’s largest community choice aggregation (CCA) program with over 3 million customers.

- Perhaps the most important features of the law from a VPP advocate’s perspective are the tax credits for heat pumps, rooftop solar photovoltaics (PV), electric HVAC upgrades, and water heaters. Each of these DER assets can be rolled into VPPs. For example, we just announced this summer a new collaboration with Willdan to leverage heat pump water heaters as resources for VPPs for the California Independent System Operator (CAISO).

- A variety of programs for electric vehicles (EVs) are also part of the legislation. Tax credits up to $7,500 are available for new vehicles and $4,000 for low- and middle-income consumers to purchase used EVs. As has been argued in the past, EVs may be the most important DER assets coming on to the nation’s grid networks. They not only reduce emissions in the transportation sector but also serve as large loads that can be modulated to soak up excess renewable energy production and stationary energy storage applications. Fleets of EVs are where the near-term opportunities lie.

- According to one estimate, the IRA includes $4.3 billion for residential demand flexibility under a national performance-based whole building programs which also aligns with the goal of VPPs to be compensated on the basis of metered demand reductions based on timing, location and reductions in greenhouse gas emissions.

Inflation Reduction Act of 2022

Grid-to-Prosumer Approach Flips the Script on Decarbonization Solution Designs

The primary thrust of the IRA legislation aligns neatly with Schneider Electric’s Grid-to-Prosumer DERMS approach. By starting with the needs of the prosumer first when conceptualizing decarbonization solutions instead of the grid itself, Schneider Electric is proposing a new approach to solving climate change and grid reliability issues simultaneously. This prosumer-centric approach aligns neatly with the IRA. In short, new advanced energy management technologies and the new law put the individual prosumer in the driver’s seat.

To multiply the impact of individual purchasing decisions for more efficient heat pumps, on-site solar PV, or a new EV, one still has to control and orchestrate these increasingly large fleets of diverse DERs in real-time to respond to the need to keep frequency and voltage in balance in the larger grid we all share. This is not an easy task.

Nevertheless, advances in AI supported by creative new market designs linking retail to wholesale markets are now paving the way to a new energy paradigm where this vision of the future can finally be realized. That’s why initiatives such as Federal Energy Regulatory Commission (FERC) Order 2222, which will allow aggregations of DER assets as small as just 100 kilowatts to be harnessed to resolve reliability challenges at the transmission level of electricity service, are also critical public policy advances. The reason why this is important to the goal of decarbonization is that when fully enacted, FERC Order 2222 will allow fleets of DER assets at the distribution level to solve balancing issues at the transmission level of electricity service, further reducing reliance upon fossil fuel peaker plants.

The challenges of orchestrating such large volumes of DER assets were once viewed as being impossible. These DER fleets were viewed as problems. Today, these DER assets can be solutions, thanks to the viability of new end-to-end solutions now coming into energy markets.

Whereas the Supreme Court ruling limiting what the EPA could do to regulate large, centralized sources of dirty electricity was a setback, the truth is many of these facilities are being retired due to their economics anyways. Instead of focusing on growing the DER assets which are emerging as the primary sources of clean electricity in our own homes and businesses, the IRA is democratizing the energy system. Each one of us can become a prosumer that can reduce pollution and reduce cost while also contributing to the greater good by balancing the larger grid. With the help of state-of-the-art DERMS platforms, the assets supported by this new federal law can help solve the resiliency, equity, and sustainability challenges facing the nation and the world.

Final Thoughts

There are many other incentives included in the IRA that can help decarbonize the U.S. economy more broadly. According to one analysis, for example, the IRA will increase the nation’s solar energy generation annually by a factor of 5 by 2030 if compared to the yearly pace of new U.S. installations in 2020. At the same time, U.S. expenditures on energy will be slashed by $50 billion per year for households, businesses, and industry by that same date.

The legislation is clearly much more comprehensive than a bill zeroed in on the needs of VPPs. Nevertheless, the fact remains that by incentivizing citizens to take their energy future into their own hands, the IRA is creating a landscape of opportunity for VPP vendors to draw from.

Even before the law was passed, global trends pointed to diverse DER assets outstripping contributions from traditional and conventional power plants. The ability to combine new extremely efficient electricity loads with clean on-site generation, batteries, and EVs creates synergies that can benefit the overall grid. These VPPs don’t just benefit prosumer market participants. Carbon emission reductions and cost savings benefits would flow to the overall economy even if a consumer did not directly invest in these DER assets. Many IRA provisions will also help reduce the cost of microgrids which can boost resiliency, an increasingly important topic as we boost our dependency upon electricity to decarbonize.

By creating a 10-year commitment to a host of green energy DER options, the U.S. is on a path toward climate mitigation that revives rather than retards the economy. Yet the only way these new assets will decarbonize, democratize, and decentralize the energy system is through creative VPP aggregations enabled by state-of-the-art DERMS platforms.