Batteries are essential to building a resilient and decarbonized grid of the future. What about pioneering installations that now show wear and tear? Aging batteries, often installed in front-of-the-meter, may not be the first resources that come to mind for keeping the lights on, but this doesn’t mean that older assets should be written off or scrapped.

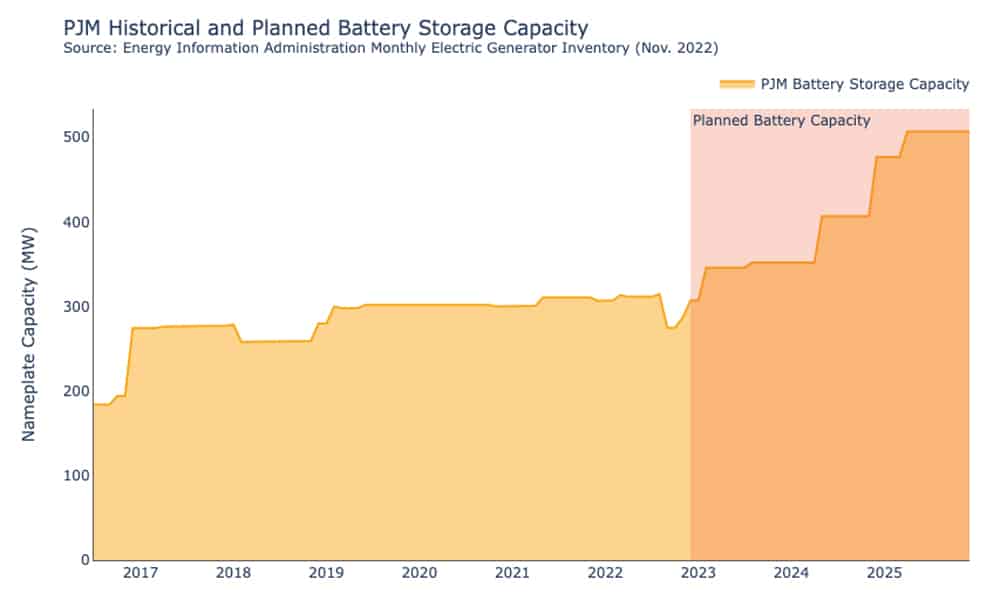

For more than five years, Uplight has managed front-of-the-meter batteries in wholesale markets, such as the control area covering Pennsylvania, New Jersey, and Maryland (PJM), which is one of the largest and most sophisticated markets for the creation of virtual power plants. With a portfolio of approximately 35 MW in PJM alone, our subsidiary Energy AI[1] bids into Ancillary Service (AS) markets to provide fast-responding services, such as frequency regulation, to keep the grid in balance. The challenge is to manage the technical constraints of older assets while maximizing revenue opportunities for customers. During the recent record-breaking winter storms that occurred over the holidays on the East Coast, these batteries helped maintain reliability and prevent blackouts.[1] One of PJM’s sites includes a nine-year-old 1 MW, 0.33 MWh lithium-ion battery that needs special care to remain a vital asset in the new energy economy.

Caring for this specific aging battery convinced us that older batteries can continue to serve throughout the energy transition.

Maximizing the Life and Value of Aging Batteries

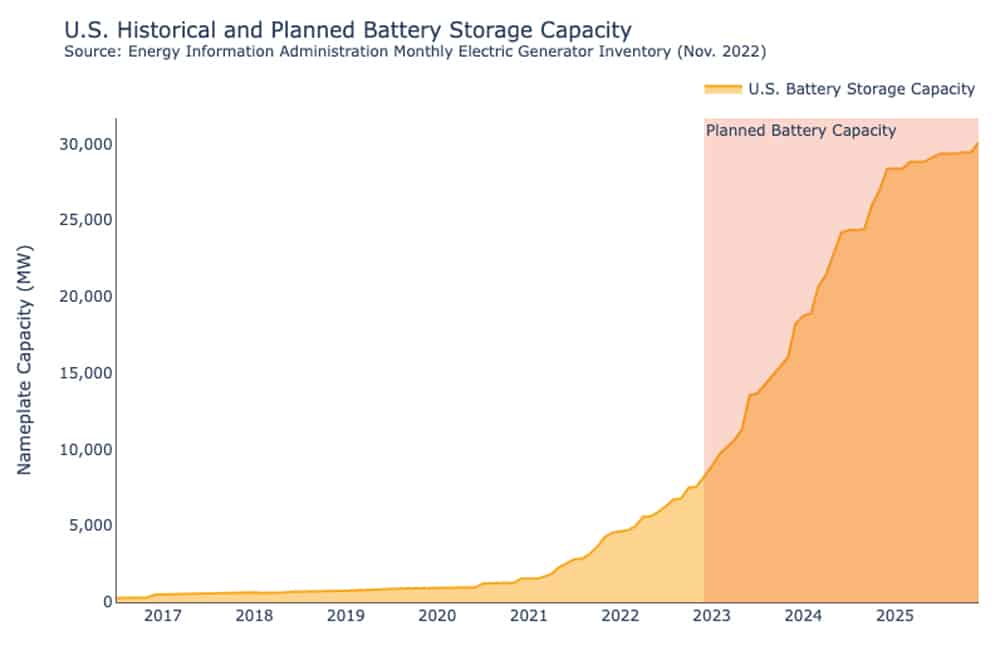

Over the past decade, large battery storage capacity has grown rapidly across the United States. With an average lifetime of eight to 10 years, the earliest pioneers now face potential end-of-life scenarios.

In its earliest days, a battery will operate subject to warranty-driven constraints. As these batteries grow older, complex challenges emerge in maintaining their health. Older batteries may start to react dramatically to ambient temperatures. Cooling system performance can erode, and control systems sometimes exhibit strange behavior due to worn-out components. Experts with hands-on control system hardware experience have helped provide real-time assistance. Their deep knowledge of how to squeeze the most value out of old batteries, especially vintage, first-generation batteries, ensures that these legacy assets remain relevant today.

In addition to human expertise, our optimization engine maximizes the revenue potential by bidding the battery capacity into ancillary service markets that keep the grid in balance while still meeting the changing operational parameters associated with these older batteries. In other words, we can weigh the benefit of running the battery at lucrative times against the potential strain of extended operation.

For this specific aging battery, the previous market operations provider grew tired of dealing with its specific needs and couldn’t get the site back online after a particular grid fault. While replacing older batteries is expensive, the skills required to maintain these batteries are specialized and rare. At Uplight, we’re fortunate to have the technology and skillset to continue monetizing older assets for a fraction of the cost of replacing them.

PJM Shows the Way for Older, Front-of-the-Meter Batteries

The issues facing aging batteries in PJM are not limited to its geography. As shown below, the fleet of batteries throughout the U.S. will continue to grow over time.

These energy storage growth trends are global. And while newer technology will offer more diverse benefits to the grid, aging batteries can still provide customer value. With the right software tools and operational experience, they can remain relevant to renewable energy growth spurred on by climate-driven legislation and regulations. As a leader in this space, we can not only optimize batteries of all ages and sizes—from behind-the-meter to front-of-the-meter—but also a diverse list of distributed energy resources (DERs) populating markets throughout the U.S. and the world. AutoGrid can monetize these storage assets across all markets, from short-term AS markets to long-term capacity contracts.

In addition to aging battery assets, some of the earliest electric vehicles (EVs) on the road are also facing scrutiny in their senior years. Some aggregators and other market participants are exploring the concept of grouping together retired EV batteries for new applications. These batteries on wheels can serve a similar purpose as the battery described in this blog, offering ancillary services to support grid reliability. The viability of these new forms of energy storage will continue to be explored over the next few years. It can also be enhanced with the right software and operational knowledge. With more EV adoption comes more EV retirements, opening the door for additional DERs that can be harnessed to create VPPs and accelerate the energy transition.